An accounting period is the time period that financial statements refer to. You have to make sure that all transactions are recorded in a timely manner so that they can be reported. A cash flow statement shows how cash is entering and leaving your business. While the income statement shows revenue and expenses that don’t cost literal money (like depreciation), the cash flow statement covers all transactions where funds enter or leave your accounts. When errors are discovered, correcting entries are made to rectify them or reverse their effect. Take note however that the purpose of a trial balance is only test the equality of total debits and total credits.

Ready to save time and money?

From time to time, you may hear it referred to as the bookkeeping cycle. The cycle typically begins with the start of a new accounting period and ends with the close of that period. One of the main duties of a bookkeeper is to keep track of the full accounting cycle from start to finish. The cycle repeats itself every fiscal year as long as a company remains in business.

Step #6: Prepare an adjusted trial balance

The structure of the Profit and loss account is different from the Balance sheet statement which predicts a line-wise reporting style. The main content and items of the Profit and loss account include the revenues, cost of goods sold, gross profit, all expenses, and the year-end income. If the amount is negative, it means that the company had incurred a loss and if the amount is positive, it means that the company had earned a significant profit within the specific time period. For example, when a transaction is recorded using accrual accounting, it happens at the time of the sale. This happens regardless of whether or not cash has moved in or out of business.

- Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions.

- The general ledger allows bookkeepers to monitor a company’s financial position.

- Most businesses are going to have numerous transactions each accounting period.

- During the accounting cycle, many transactions occur and are recorded.

Step #8: Close the books

Its format is similar to that of an unadjusted and adjusted trial balance. However, it lists only permanent accounts because all temporary accounts get closed in step 8 above. The post-closing trial balance serves as the base or opening trial balance for the next period’s accounting 13 things bookkeepers do for small businesses cycle. The main purpose of drafting an unadjusted trial balance is to check the mathematical accuracy of debit and credit entries recorded under previous steps. Posting is the process of forwarding journal entries from journal book to ledger book, commonly known as general ledger.

The Accounting Cycle: 8 Steps You Need To Know

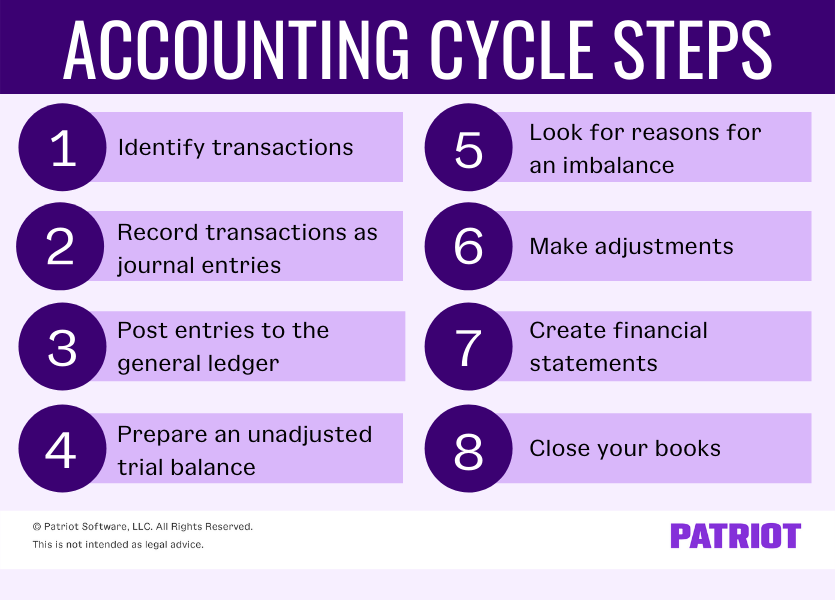

The accounting cycle is used by businesses and organizations to record transactions and prepare financial statements. It also helps to generate financial information to perform financial statement analysis and manage the business. The process starts with analyzing incoming and outgoing transactions like purchases and sales. It ends with preparing financial statements, like the balance sheet, income statement, and cash flow statement, and closing the books.

Record to Report

Meanwhile, single-entry accounting is more like managing a checkbook. It doesn’t require multiple entries but instead gives a balance report. The accounting cycle is a comprehensive process designed to make a company’s financial responsibilities easier for its owner, accountant or bookkeeper to manage. The accounting cycle breaks down financial management responsibilities into eight essential steps to identify, analyze and record financial information.

Bookkeepers analyze the transaction and record it in the general journal with a journal entry. The debits and credits from the journal are then posted to the general ledger where an unadjusted trial balance can be prepared. Once you make adjusting journal entries, you run a trial balance one more time.

If you have a staff, give them the tools they need to succeed in implementing the accounting cycle. This could mean providing quarterly training on best practices, meeting with your staff each cycle to find their pain points, or equipping them with the proper accounting tools. This is a straightforward guide to the chart of accounts—what it is, how to use it, and why it’s so important for your company’s bookkeeping. A balance sheet can then be prepared, made up of assets, liabilities, and owner’s equity. In other words, deferrals remove transactions that do not belong to the period you’re creating a financial statement for.

An adjusted trial balance may be prepared after adjusting entries are made and before the financial statements are prepared. This is to test if the debits are equal to credits after adjusting entries are made. The accounting cycle is a collective process of identifying, analyzing, and recording the accounting events of a company. It is a standard 8-step process that begins when a transaction occurs and ends with its inclusion in the financial statements and the closing of the books. After the adjusting entries have been passed and posted to respective ledger accounts, the unadjusted trial balance needs to be corrected to show the impact of these adjustments.

No Responses