Frequency of a year is the amount of time for the note and can be either days or months. Since notes receivable have a longer duration than accounts receivable, they usually require the maker to pay interest in addition to the principle, at the maturity of the note. manufacturing financial statements Interest receivable is recognized on the balance sheet in addition to the face value of notes receivable. The amount loaned to the employee invariably will be higher than the present value using the market rate because the loan is intended as a reward or incentive.

Notes receivable accounting:

Such notes can arise from a variety of circumstances, not the least of which is when credit is extended to a new customer with no formal prior credit history. The maker of the note is the party promising to make payment, the payee is the party to whom payment will be made, the principal is the stated amount of the note, and the maturity date is the day the note will be due. Notes receivables are written promissory notes which give the holder or bearer the right to receive the amount mentioned in the agreement.

- Frequency of a year is the amount of time for the note and can be either days or months.

- Starbucks uses Square to process transactions with credit or debit card customers.

- The Statement of Financial Position (a.k.a Balance Sheet using Canadian ASPE accounting standards) presents the company’s total assets,…

- In this case the note receivable is issued to replace an amount due from a customer currently shown as accounts receivable.

- The accounts receivable is just as valid a claim as are the notes receivable, as well as the interest.

Step 2 : Effective Interest Method, required by IFRS

In some industries, it is common for a seller to insist on a note rather than an open account for certain types of sales. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

Trial Balance

Likewise, at the end of the note maturity, the balance of non-interest-bearing note receivable will increase to the amount of its face value. In accounting, the face value of a non-interest-bearing note is usually the maturity value of the note which is also known as future value. Likewise, the company needs to calculate the note’s present value which is its fair value at the present date before it can make the journal entry for the non-interest-bearing note receivable. For example, if a business wants to borrow $7,000, Square might charge a total of $7,910 for the loan.

Maturity Date

For example, the maker owes $200,000 to the payee at a 10% interest rate, and pays no interest during the first year. Or, we can combine this entry with the journal entry for the repayment of the note. Rather than using Interest Receivable for the one day of interest in April, we record it as part of the cash payment, skipping the step of first entering it in the receivable.

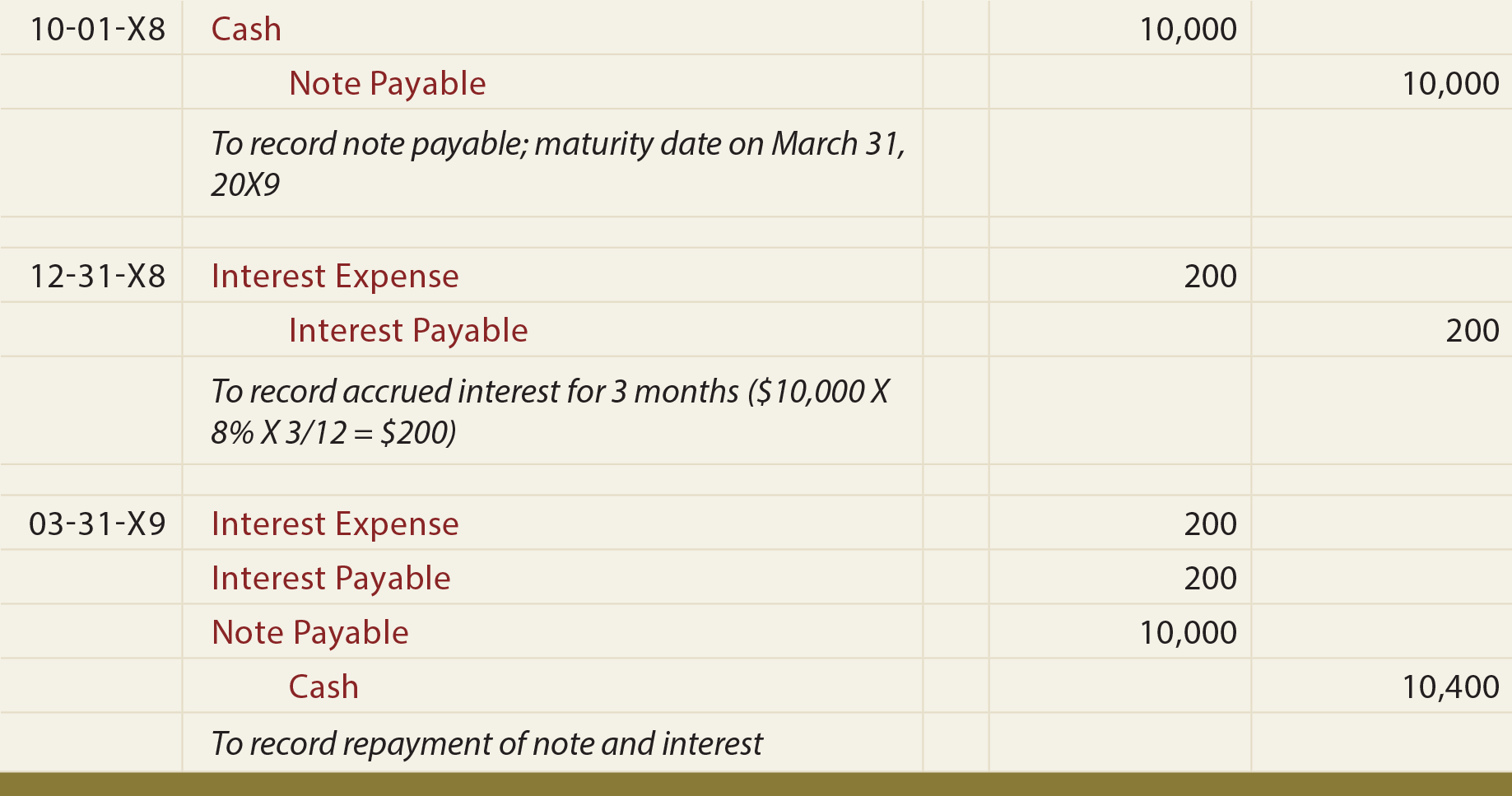

A Note Payable is recorded when a company is on the “paying” side of a debt. The difference in recording is based on which side of the transaction a company is on. When the note’s maturity rises after the completion of 90 days, the interest amount is paid to MPC. FV is the payment at the end of six months’ time (future value) of $5,000. After a year, ABC Co. must record the receipt when the customer repays the loan.

When a note receivable originates from an overdue receivable, the payment tends to be relatively short – typically less than one year. The straight-line method is easier to apply but its shortcoming is that the interest rate (yield) for the note is not held constant at the 12% market rate as is the case when the effective interest method is used. This is because the amortization of the discount is in equal amounts and does not take into consideration what the carrying amount of the note was at any given period of time. At the end of year 3, the notes receivable balance is $10,000 for both methods, so the same entry is recorded for the receipt of the cash.

However, the customer will also pay an interest of $500 ($5,000 x 10%) on the note. Similarly, a note receivable gives the holder, or the lender, the right to receive the amount from the borrower. Accounting for the assigning or factoring of accounts receivable are topics that are typically covered in an intermediate accounting text. For example, assume that the Bullock Company has received a 3-month, 18% note for $5,000 dated 1 November 2019 in exchange for cash. The firm’s year-end is 31 December, and the note will mature on 31 January 2020.

Determining present values requires an analysis of cash flows using interest rates and time lines, as illustrated next. If the note term does not exceed one accounting period, the entry showing note collection may not reflect interest receivable. For example, let’s say the company’s note maturity date was 12 months instead of 24 (payment in full occurs December 31, 2018).

No Responses